The Call That Uses Fear

A phone rings. The caller ID looks local or even shows a government number. A calm — or aggressive — voice says you owe a fine, missed jury duty, or taxes. If you don’t pay immediately, they warn, an arrest warrant will be issued.

These calls are designed to short-circuit reasoning by triggering fear and urgency. They’re highly effective, and increasingly convincing because scammers now spoof real numbers to appear legitimate.

How the Scam Works — the playbook

- Spoofed caller ID. Scammers manipulate caller ID so it looks like it’s coming from a sheriff’s office, court, or the IRS. That legitimacy makes people answer and comply.

- High-pressure script. The caller uses urgent language, threatens arrest, or claims legal action unless immediate payment is made.

- Payment demands. They insist on payment by wire transfer, prepaid gift cards, cryptocurrency, or payment apps — methods that are hard to trace or reverse.

- Personal data harvesting. As a fallback, they ask for personal details (SSN, DOB, bank info) saying it’s “to verify identity.”

- Follow-up harassment. If you resist, they may call repeatedly, escalate threats, or try to socially engineer someone in your network.

Why it’s so convincing

- Caller ID spoofing can show a real sheriff’s office number or a local police department, which people trust.

- Authority bias makes recipients more likely to obey a command from a perceived official.

- Emotional pressure (fear of arrest, loss of license, immediate fines) reduces time for critical thinking.

- Scripting and training: Some operations train callers to sound official and to handle objections.

- Targeting of vulnerable groups: seniors and non-native speakers are often targeted because they may be more trusting or less likely to verify.

Red flags to spot immediately

- They demand immediate payment or threaten arrest without providing verifiable case or badge numbers.

- Payment requests by gift card, crypto, wire transfer, or peer-to-peer apps. Government agencies do not accept these forms for fines.

- They ask you to keep the call secret or to not contact family/lawyers.

- They ask for full Social Security number, online banking credentials, or one-time passwords (OTPs). Legitimate agencies will not ask for these over the phone.

- The caller presses you to act right away and uses intimidation tactics.

If you get one of these calls — step-by-step

- Stay calm and hang up. Don’t provide any information and don’t press buttons.

- Do not call back the number shown. It may route you to the scam. Use official channels to verify.

- Verify independently. Look up the agency’s official phone number from a government website or a trusted source and call them directly. Don’t trust caller ID.

- Document the call. Note the number displayed, the time, and what was said. This helps when reporting.

- If you gave payment or info, act fast: contact your bank/credit card company to dispute charges, change compromised passwords, and freeze accounts if needed.

- Report the scam to authorities (see reporting section below). The more reports authorities have, the better their ability to warn others.

Recovery steps if you already paid or gave personal info

- Contact your bank or card issuer immediately and request a fraud claim or charge reversal.

- If you shared account credentials or OTPs, log in from a secure device and change passwords; enable app-based 2FA.

- If you gave Social Security number or ID details, visit IdentityTheft.gov to start a recovery plan and consider placing a fraud alert or credit freeze.

- If you used gift cards or crypto, report the transaction to the vendor; recovery is difficult but report anyway.

- File police and FTC reports (local police for record; FTC helps track patterns). Keep copies of everything.

Who to contact and how to report

- Local police or sheriff’s office — call their published number to let them know someone is spoofing their identity.

- Federal Trade Commission (FTC) — report at reportfraud.ftc.gov.

- Internet Crime Complaint Center (IC3) — for scams with an online/crypto angle (ic3.gov).

- Your bank or credit card company — to dispute charges and secure accounts.

- Your state attorney general — many states track and act on scam complaints.

- Carrier spam tools — forward spam SMS to your carrier if applicable and use carrier blocking features (#662# for some carriers).

Prevention: policy and personal defenses

- Never pay by gift card, wire, or crypto for an alleged fine. Legitimate agencies use official billing methods and will send written notices.

- Verify via official channels. If a “sheriff” calls, get the incident/case number and hang up. Call the published number for the sheriff’s office to confirm.

- Teach family and employees. Run a brief training on scam scripts and verification steps, especially for older relatives and frontline staff.

- Add a household/business policy: never conduct sensitive transactions over the phone unless initiated by you and verified by an independent number.

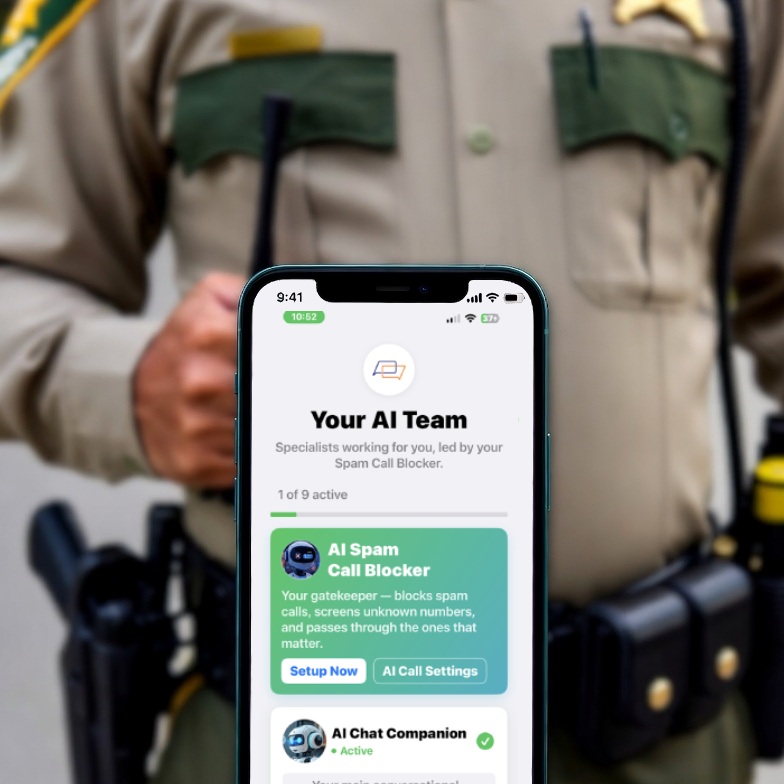

- Use phone protections: carrier spam filters, Silence Unknown Callers (iPhone), and a smart blocker to reduce exposure to spoofed numbers.

Emerging variants (2025 trends to watch)

- Voice-cloned impersonations. Scammers use AI to mimic the voice of a real official or a known person to increase believability.

- Multi-channel attacks. A phone call followed by an official-looking email or SMS to create a sense of legitimacy.

- Localized spoofing. Calls spoof local court or municipal numbers and reference local ordinances to sound credible.

- Credential harvesting via OTPs. Scammers trick victims into revealing one-time codes that bypass 2FA.

Why AI call blocking matters for this scam

Law-enforcement impersonation scams rely heavily on spoofing and volume. Static number lists and manual blocking can’t keep up. An AI-driven call blocker analyzes call behavior, script patterns, and community signals in real time — catching high-risk impersonation attempts even when the caller ID appears legitimate. That means fewer intimidating calls reaching you and a lower chance of emotional pressure causing costly mistakes.

Messaging to protect seniors and vulnerable people

- Use clear, simple instructions: “If someone calls saying you owe a fine, hang up and call the phone number on your official bill or the county website.”

- Create a household rule: “If a caller asks for payment immediately, always verify with a second person or the official website.”

- Offer to register elders’ phone numbers on protective services, and set up a trusted contact who can verify suspicious calls.

Sample verification script you can use when you’re unsure

“I’m concerned about the legitimacy of this call. Please provide your name, department, and a case number. I will call back using the number from your official website.”

If the caller pushes back: hang up. Real officials will understand verification and will not threaten arrest to stop you from verifying.

Final takeaways

- Law-enforcement impersonation scams are effective because they weaponize authority and fear.

- Caller ID is unreliable — always verify using official, published contact info.

- Never pay immediate fines by gift cards, crypto, or wire transfers.

- If you’re targeted, document the call, report it, and take swift action if you shared money or sensitive data.

- Use layered defenses — education, carrier protections, phone settings, and AI-powered call blocking — to reduce risk.